Are one in five British companies really scams?

A grim prospect. And possibly true, according to our analysis.

When members of Parliament quizzed officials over the extent of fraud in the UK economy last month, their frustration was evident. “Do you not think that it might be a good idea to have a strategy?” was just one of the barbed questions put to the boss of HMRC, the country’s tax agency.

While HMRC itself estimates that £5.5bn is lost to tax fraud each year (about 0.7 per cent of all tax owed), the Public Accounts Committee suspects it is far higher. In urging government fraud-busters to raise their game, its members lamented not only the lack of action in addressing tax fraud, but what they perceived to be official indifference to its extent. “HMRC is not sufficiently curious about the true scale of tax evasion,” they concluded.[1]

HMRC suspects that around four fifths of tax evasion involves small businesses, both real and fake. Checking that newly formed companies are bona fide is critical. But new powers to enable Companies House (the UK’s corporate registry) to verify filings and investigate suspected trickery won’t be fully deployed before the end of next year. So the scams persist.

The committee asked Louise Smyth, Chief Executive of Companies House, how many new company registrations are fraudulent. Citing internal estimates of five per cent and those of “external commentators” at 20 per cent, she could not be pinned down. “I suspect the figure is somewhere between the two.” Students nervously awaiting upcoming maths exams can only dream that such answers were allowed.

Greyhawk’s snap analysis suggests that the true figure could be at the upper end of Ms Smyth’s range. On a single day this month (Wednesday 19 March), some 3,992 new companies were incorporated in the UK.

The most cursory analysis rings alarm bells. Over 500 share the same address in north London, one instantly recognizable to corporate sleuths. Others carry the names of well-known brands, but with missing vowels, ready to be used in phishing emails. A remarkable number of directors are based in China.

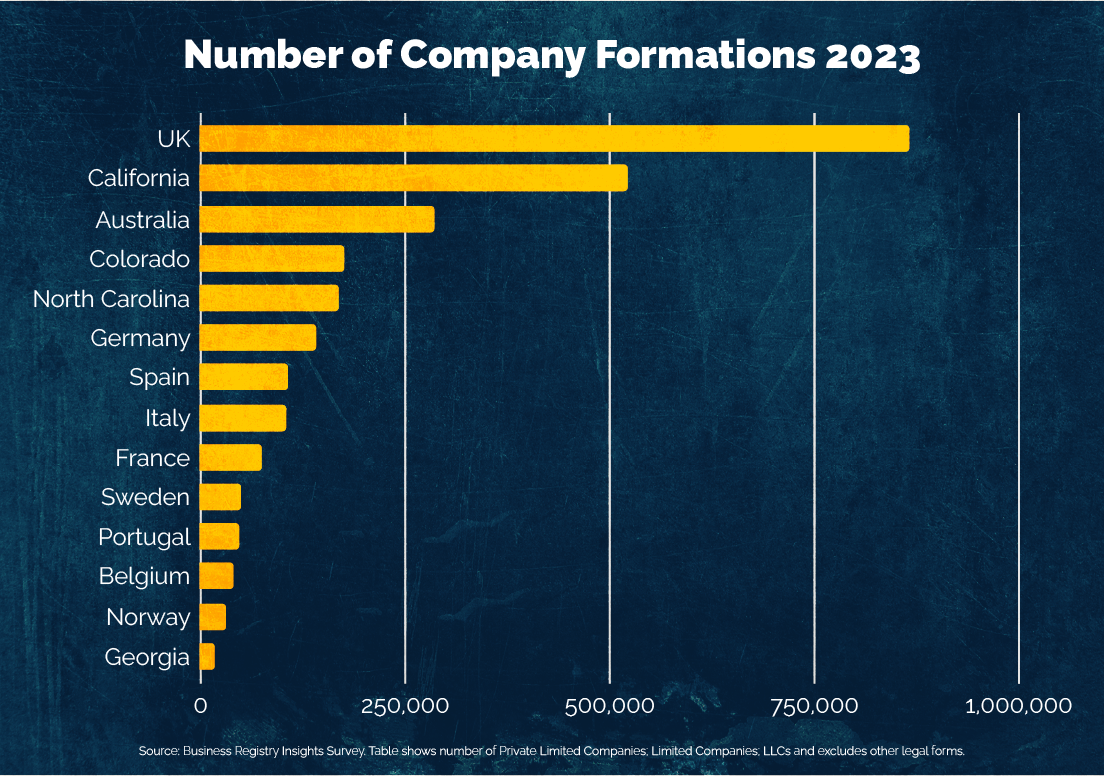

International comparisons suggest the UK is an outlier. In 2023, twice as many companies were incorporated in the UK than in Germany, Spain, Italy, and France combined. It incorporated roughly twice as many companies as California, despite its economy being about 12 per cent smaller.[2]

Could these numbers instead reveal a surge in entrepreneurship in our nation of shopkeepers? Sadly, no. Data for company terminations (businesses closing one way or another) are starker still. British companies perish at the same rate as they are born. Some 666,000 UK companies were shuttered in 2023, nearly eight times as many as in France, the next highest country.

The UK is struggling to raise enough tax to pay for public services and every penny counts. The Economic Crime and Corporate Transparency Act 2023 gave Companies House new powers. It’s time to use them.

[1] Tax Evasion in the Retail Sector, 12 February 2025, Committee of Public Accounts.

[2] Source: Business Registry Insights Survey. Table shows number of Private Limited Companies; Limited Companies; LLCs and excludes other legal forms. Australia’s sole traders, making up about a third of that country’s new businesses, are not included.

Contact us:

"*" indicates required fields